Wealth Services

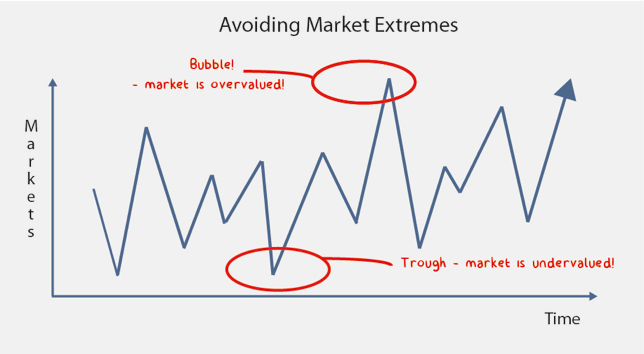

The key to accumulating wealth is to make a start. Wealth is all about how you nurture and direct your money, and timing is key. Your short term goal is to pay the bills and support your family. Your long term goal is to achieve financial freedom to live the life you choose.

Minnik Chartered Accountants are dedicated to helping you to establish, maintain and grow your wealth. We do this by delivering wealth education to families in business.

We are affiliated with Plenary Wealth who provide financial planning support to our education process.

Healthy income years are limited. Our mantra is to remain focussed when income streams are strong, and manage them wisely. Essential to wealth is understanding your numbers, knowing where you are at and where are you headed. Your wealth journey will be something you become passionate about your entire life.

Don’t let another year slip away – embark on your journey to wealth

Meet our Wealth Educator, Leah Oliver CA, Minnik Chartered Accountants

Meet our Wealth Strategist, Julian Nowland, Plenary Wealth

Further details on wealth services are outlined below.

Learn more by booking a Minnik Consult