Helping to Minimise Your Tax

Tax must be both accepted and properly managed for optimum results. Tax is one piece of a much larger picture of your business, and is dealt with accordingly. The key for business owners to understand is that paying more tax is a direct result of earning more profit. More profit equates to increased wealth, so a high tax bill is in fact the sign of a healthy business.

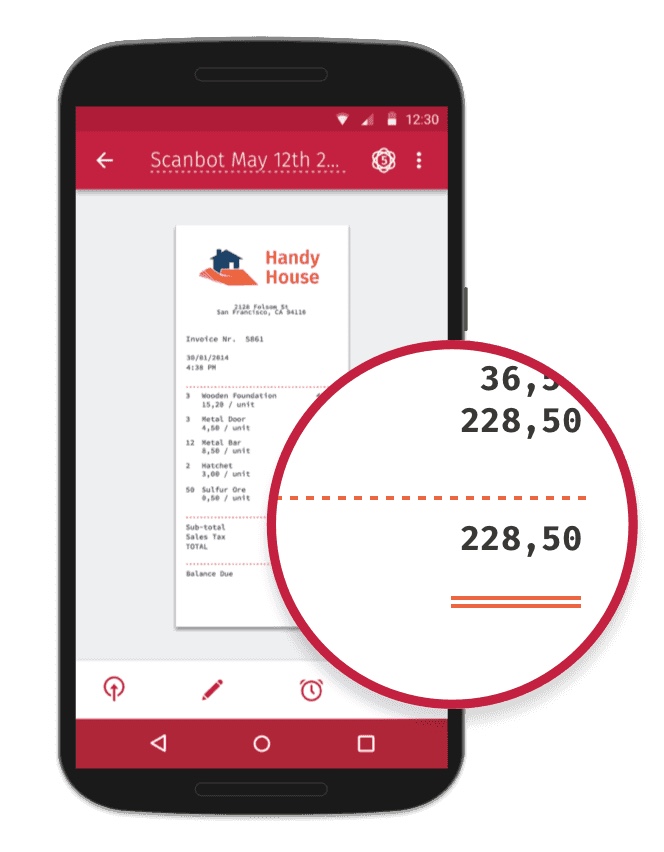

Details