With the end of the financial year rapidly approaching, it’s time to undertake a final review of your super to ensure that you have maximised your tax and retirement benefits for the 2016-17 year, as well as prepare for the new changes that commence on 1 July 2017.

So what should you be considering in terms of super prior to 30 June 2017?

Maximise super contributions

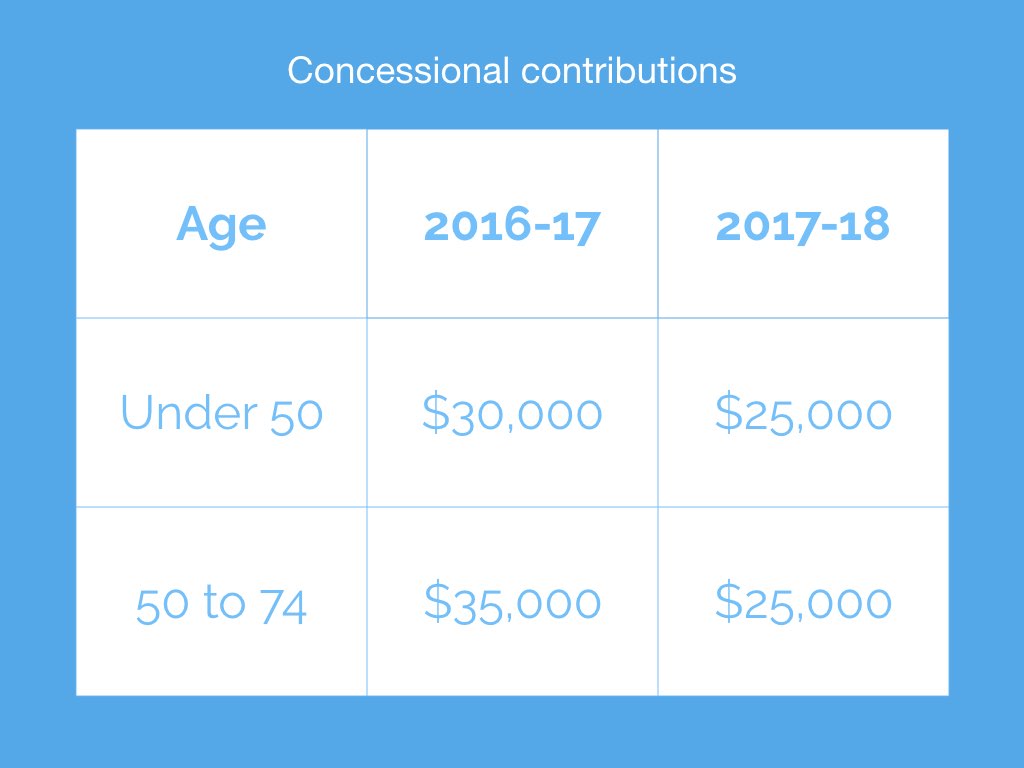

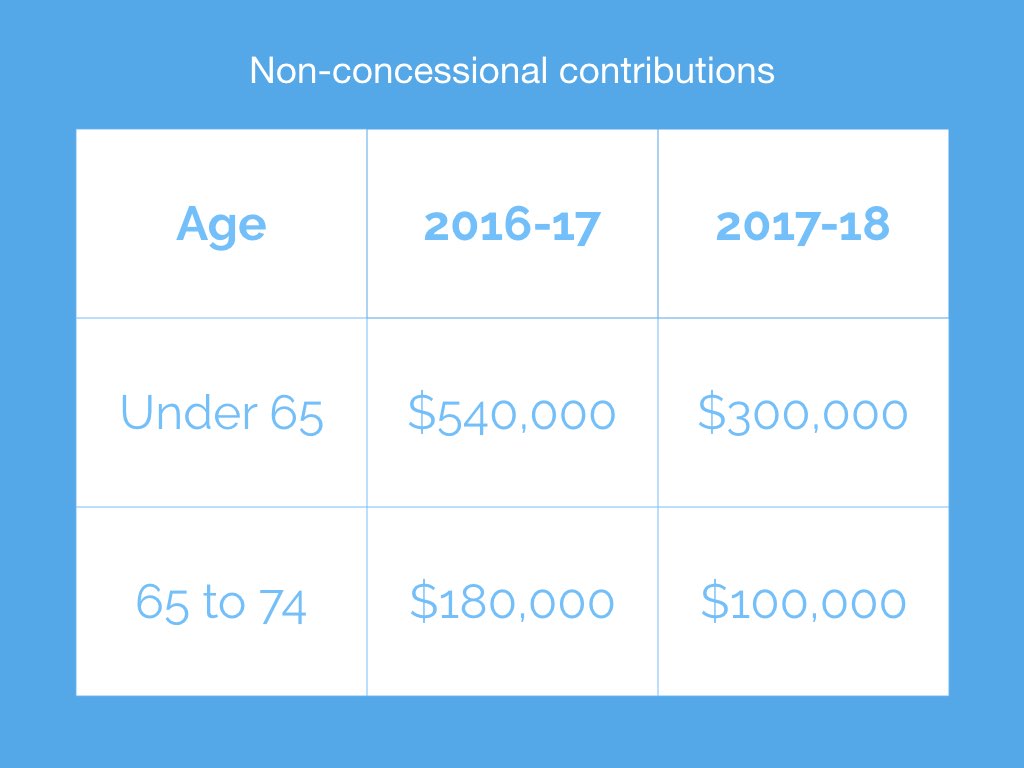

Ensure that you have maximised your annual concessional (tax deductible) and non-concessional (undeducted or after-tax) super contributions. The following tables summarise the contribution caps for the current financial year as well as the contribution caps applicable after 1 July 2017:

- This cap is inclusive of any 9.5% compulsory employer contributions made on your behalf.

- If you turn age 50 at any time during the 2016-17 year you are eligible for the higher cap of $35,000 for the 2016-17 year.

- Those earning more than $300,000 will pay an additional 15% contributions tax on their concessional contributions.

- If you are aged 65 and over, you need to satisfy a work test of gainful (paid) employment of at least 40 hours in a consecutive 30 day period during the financial year in order to be eligible to contribute to superannuation.

- If you are over age 75, only mandated or compulsory super guarantee contributions are permitted.

- For those under age 65, the non-concessional contribution caps listed are based on the annual non-concessional cap (i.e. $180,000 for 2016/17 and $100,000 for 2017/18) brought forward over 3 years and would only be applicable for those people that have not exceeded their annual non-concessional contribution cap in the prior 2 financial years.

- If you turn age 65 at any time during the 2016-17 year you are still eligible for the bring forward allowance of $540,000 for the 2016-17 year, but if you contribute after your 65th birthday you will need to meet the work test (see next point) for the 2016-17 year.

- If you are age 65 and over, you need to satisfy a work test of gainful (paid) employment of at least 40 hours in a consecutive 30 day period during the financial year in order to be eligible to contribute to superannuation.

- If you are over age 75, non-concessional contributions are not permitted.

Furthermore, from 1 July 2017, individuals with total superannuation balances of $1.6m or more, generally, will no longer be eligible to make non-concessional contributions to superannuation.

Therefore for these individuals, the 2016-17 year may be the final year in which they can make non-concessional contributions to superannuation.

Also note your super contribution will not be counted for this financial year unless the payment is received by your super fund prior to 30 June 2017.

So please allow for expected time delays depending on your method of payment.

Review your salary sacrifice agreement

Review your salary sacrifice agreement to ensure that you have maximised your salary sacrifice superannuation contributions for the 2016-17 financial year. If you do not have an agreement in place, then consider establishing an agreement with your employer for the 2017-18 financial year.

Personal concessional contributions and notice requirements

If you are eligible to make a concessional contribution in which you are able to claim a tax deduction, then you need to ensure that you have notified your super fund in writing of your intention to claim a tax deduction and you should also ensure that you receive an acknowledgment of your intention from your super fund. Without the notice and acknowledgment, your claim for a tax deduction for your personal contributions will be invalid.

Make a spouse super contribution

You may be entitled to an income tax offset of up to $540 for superannuation contributions for the benefit of a low-income (under $13,800) or non-working spouse who is under age 70.

Access the Government co-contribution of up to $500

If you under age 71, engaged in employment and your total income is less than $51,021, the government will co-contribute 50 cents for every $1 of any non-concessional (undeducted) super contributions that you make, up to a maximum of $500. This may be a useful strategy for low income working spouses or adult children working part-time.

Consider starting a pension from superannuation

If you are over age 55, consider commencing a pension from your super fund. Under the current super rules, anyone who has reached “preservation age” (55 for those born before 1 July 1960), can start a “transition to retirement income stream” (TRIS) and draw up to a maximum of 10% of their account balance each year. This is irrespective of whether they continue to work or not. Many use this strategy to reduce their tax but more importantly, increase their contributions to superannuation whilst supplementing their reduced take-home pay with their pension withdrawal.

Note, after 1 July 2017, earnings in super funds paying a TRIS will be subject to tax in the fund at 15% (currently these fund earnings are tax free).

Therefore if you are currently drawing a TRIS from your super fund, you need decide by 30 June 2017 whether to stop your TRIS or continue receiving it.

Alternatively, if you are over age 65, or if you are under age 65, but have retired since commencing the TRIS, or if you are between age 60 and 65 and changed jobs after age 60, then you may convert your TRIS to a “retirement phase pension”. After 1 July 2017, the earnings on super funds paying retirement phase pensions continue to be tax free, but only on fund earnings based on a maximum of $1.6 million of pension fund assets (see below).

Draw your minimum pension before year end

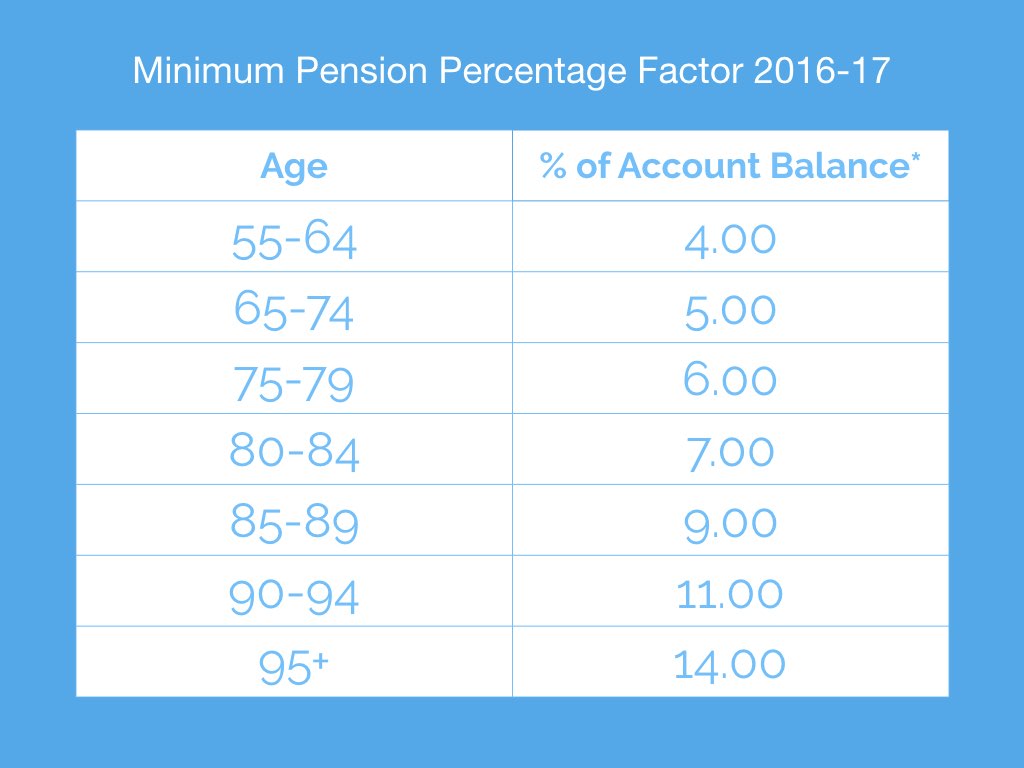

If you are already drawing a superannuation pension, please ensure that your fund has paid you the minimum pension before 30 June 2017. The minimum pension for the year is based on a percentage of your fund member balance as at 1 July 2016, or, if you started your pension during the year, the fund member balance at commencement pro-rata for part year. The minimum pension percentage factor for the 2016-17 year is as follows:

There is no maximum annual limit to your account-based pension, unless you are under age 65, still working and drawing a pension from your super fund, in which case the maximum annual limit is 10%.

Action required on super pension balances over $1.6 million

On 1 July 2017, retired individuals drawing a pension from their superannuation fund will only be allowed to have up to $1.6 million of their superannuation balance in pension phase in which the earnings in their superannuation fund are tax free (the balance above $1.6 million will be taxed at 15% and does not need to be taken out of the superannuation system) (currently there is no cap on the amount an individual can have in tax free pension phase).

Therefore for individual pension balances above $1.6 million, action needs to be taken before 30 June 2017 to either, withdraw the excess amount from superannuation, or leave the excess in superannuation in “accumulation” mode with the earnings in the fund taxed at 15%. If you take no action before 1 July 2017, you will be required by the ATO to remove the excess amount (including any deemed earnings) and be liable for an ATO imposed excess transfer balance cap tax.

Thinking about setting up an SMSF before year end?

If you are planning to set up a self managed super fund (SMSF) before year end, it may be better to defer the set up until after 30 June 2017, so as to avoid the fixed annual SMSF compliance costs that will apply regardless of how long the SMSF has been in operation.

Leah Oliver and the team at Minnik Integrated Financial Solutions are passionate about assisting you and your family to achieve financial security and freedom. Contact us today to understand how we can assist you to minimise your tax, and establish, grow and maximise your wealth position.